|

Franklin India Feeder - Franklin U.S. Opportunities Fund As on April 30, 2025 |

|

|

An open ended fund of fund scheme investing in units of Franklin U. S. Opportunities Fund

SCHEME CATEGORY

FOF - Overseas - U.S.

SCHEME CHARACTERISTICS

Minimum 95% assets in the underlying funds

INVESTMENT OBJECTIVE

The Fund seeks to provide capital appreciation by investing predominantly in units of Franklin U. S. Opportunities Fund, an overseas Franklin Templeton mutual fund, which primarily invests in securities in the United States of America.

DATE OF ALLOTMENT

February 06, 2012

FUND MANAGER(S)

(FOR FRANKLIN INDIA FEEDER - FRANKLIN US OPPORTUNITIES FUND)Sandeep Manam

FUND MANAGER(S)

(FOR FRANKLIN US OPPORTUNITIES FUND)Grant Bowers

Sara Araghi

BENCHMARK

Russell 3000 Growth Index

PLANS

Growth and Dividend (with payout and reinvestment option)

MINIMUM APPLICATION AMOUNT

₹ 5,000 and in multiples of Re.1 thereafter

EXPENSE RATIO#: 1.54% EXPENSE RATIO# (DIRECT) : 0.65%

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

| Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : | 1% if Units are redeemed/switched out within one year from the date of allotment (effective January 15, 2020) |

‘Investors may note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes in which this Scheme makes investment’

| Growth Plan | Rs65.7421 |

| IDCW Plan | Rs 65.7421 |

| Direct - Growth Plan | Rs74.1346 |

| Direct - IDCW Plan | Rs 74.1346 |

| As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs3511.12 Crores |

| Monthly Average | Rs3362.27 Crores |

| Company Name | No. of shares | Market Value Rs Lakhs | % of assets |

| Mutual Fund Units | |||

| Franklin U.S. Opportunities Fund, Class I (Acc) | 46,41,619 | 3,48,045.02 | 99.13 |

| Total Mutual Fund Units | 3,48,045.02 | 99.13 | |

| Total Holdings | 3,48,045.02 | 99.13 | |

| Call,cash and other current asset | 3,067.02 | 0.87 | |

| Total Asset | 3,51,112.03 | 100.00 | |

@ Reverse Repo : 1.29%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : -0.42%

Disclaimer :

Subscriptions to shares of the Luxembourg-domiciled SICAV Franklin Templeton Investment Funds (“the Fund”) can only be made on the basis of the

current prospectus, and, where available, the relevant Key Investor Information Document, accompanied by the latest available audited annual report

and the latest semi-annual report if published thereafter. The value of shares in the Fund and income received from it can go down as well as up, and

investors may not get back the full amount invested. Past performance is not an indicator or a guarantee of future performance. Currency fluctuations

may affect the value of overseas investments. When investing in a fund denominated in a foreign currency, your performance may also be affected by

currency fluctuations. An investment in the Fund entails risks which are described in the Fund’s prospectus and in the relevant Key Investor

Information Document. In emerging markets, the risks can be greater than in developed markets. Investments in derivative instruments entail specific

risks more fully described in the Fund’s prospectus or in the relevant Key Investor Information Document. No shares of the Fund may be directly or

indirectly offered or sold to residents of the United States of America. Only Class A shares can be offered by way of a public offering in Belgium and

potential investors must receive confirmation of their availability from their local Franklin Templeton Investments representative or a financial services

representative in Belgium before planning any investments. Any research and analysis contained in this document has been procured by Franklin

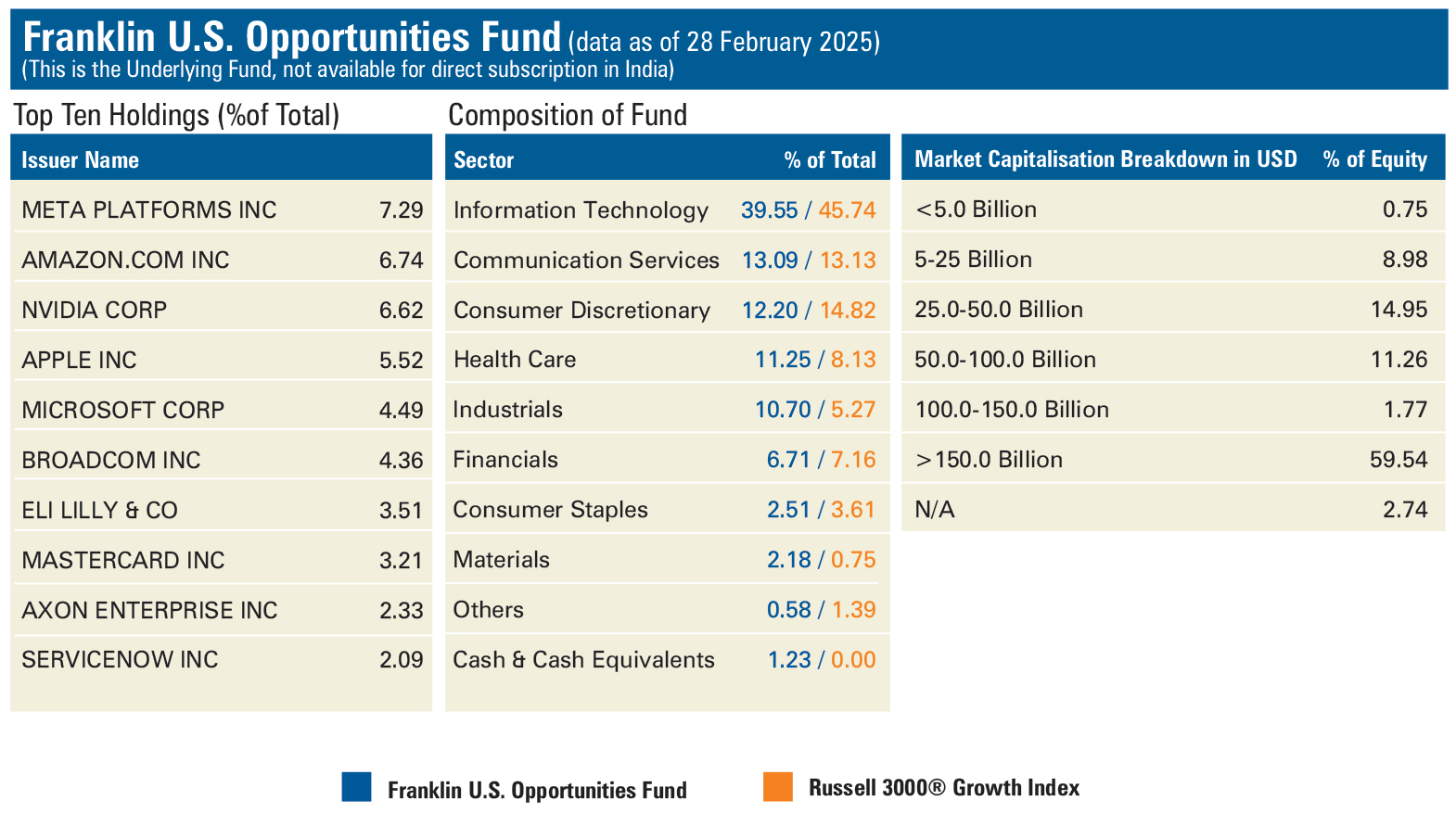

Templeton Investments for its own purposes and is provided to you only incidentally. Top Ten Holdings: These securities do not represent all of the

securities purchased, sold or recommended for clients, and the reader should not assume that investment in the securities listed was or will be

profitable. The portfolio manager for the Fund reserves the right to withhold release of information with respect to holdings that would otherwise be

included in the top holdings list.

The expenses of the Fund of Funds scheme will be over and above the expenses charged by the underlying scheme. Investments in overseas financial

assets are subject to risks associated with currency movements, restrictions on repatriation, transaction procedures in overseas markets and

country related risks.

Investors cannot directly invest in the Underlying fund, as the Underlying fund is not available for

distribution.

Please click here for Product Label & Benchmark Risk-o-meter.